The competition among financial service providers forces them

to reduce the cost of their services and at the same time improve the customer

satisfaction and convenience. In order to achieve the improved business performance,

the banking industry has been relying on Artificial intelligence powered by big

data and machine learning aka Data Science.

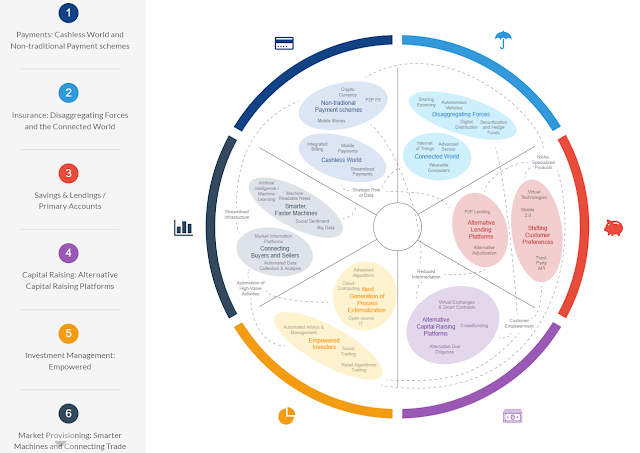

According to world economic forum this is where financial services are

going and what technologies will enable the financial institutions to provide

these services.

Figure 1 Forum, W.E. (2016) Future of

Financial Services. Available at: Source

(Accessed: 13 June 2016).

What is central to all these sub sectors? All of them need

to make use of data analysis in some way or the other.

Day by day new companies are entering the financial market

with innovative solutions relying heavily on Data analysis. As discussed in our

previous blogs in the series, the biggest threats and challenges these companies

pose for the traditional financial industry players are:

- Sub-sector Boundaries are blurring – The newer products from these innovative entrants are creating competitive pressure across sub-sectors. Phenomenon like alternative lending, crowdfunding and robo-advisors like betterment.com are challenging the retail banks and taking their customers away.

- Customer ownership is lost – Traditionally, financial institutions relied on bundled services. But the emergence of these niche providers encourages customers to shop around. Moreover, the technology oriented firms offer amazing digital experiences, which is a preferable choice for most specially the youngsters.

- Customer behaviour is changing – With all these online options the customers have a wider mix of options available to choose from. Young adults are taking control of their finances and want the best experience from their financial services providers at a minimum cost. If you can not provide what they want, they will be happy to switch.

Given these challenges, the traditional financial institutions

also have an opportunity. The traditional institutions can also leverage the

use of Data science in their operations and use the data from both on-grid as

well as off-grid channels such as social media to provide on par services to

their customers. The early adopters are already reaping the benefits of big

data. As per a recent global CIO survey conducted by CSC (CSC, 2014), 72%

respondents from financial services sector said that Big Data had a positive

impact on their rate of innovation and 77% believe that Big data has improved their

productivity and efficiency.

The figure below shows the emerging application areas where

financial sector now is using data science to provide better services and

improve business performance.

Source: Frost & Sullivan, (2016), AI impacting Banking

& Financial Services Overview [ONLINE].

Available at source

[Accessed 13 June 2016]

These threats and opportunities balance the future landscape

of the financial services. It also means that it is unlikely that this

landscape will be populated by many outright winners or losers per se. Rather, companies

will be collaborating with each other to help themselves and others, especially,

in fraud detection and prevention – which is a huge priority for the sector. It

is possible that we may be seeing a new platform that aggregates information

from entire industry and find trends and patterns in fraud. Thus if a new treat

or scam appears all the banks can be informed immediately so that the risk of

multiple banks seeing the same frauds will be mitigated immediately and that

too without each of them investing separately in the infrastructure to make

this happen.

Despite all the positive influence there are challenges that

are common to all financial players looking to implement a big data strategy.

One of the key challenge for big data is getting quality data, Banks although

have wealth of data most of this data is kept in silos within different

divisions. Making a central data repository or as some experts say, “Data mart”,

is challenging as it requires integration within old legacy systems. This is

time consuming and expensive. The other challenge that banks face is that most

of the big data strategies have cloud as their infrastructure platform.

Financial institutions in particular are hesitant about bringing their data to

cloud as the regulators keep a tight check on them. Thus understandably, banks

prefer to err on the side of caution. But as the cloud services evolve and get

more secured, this can change very soon. One challenge that financial industry

luckily does not face is getting the right people to get insights from data.

Although, they have the right people to do it, it is expensive for the banks to

keep employing them.

Some of the biggest banks are already testing their newer

applications on cloud. For example, a consortium of major world banks including

JP Morgan Chase, BofA Merrill Lynch, BNY Mellon, BlackRock, Citadel, Citi,

Credit Suisse, Deutsche Bank, Goldman Sachs, Jefferies, Maverick, Morgan

Stanley, Nomura and Wells Fargo recently invested in a venture called Symphony

to provide secure, cloud based communication platform (LLC, 2014).

With all that said, it is evident that Data science is going

to be integral to a banks digital strategy for all major innovations and operations.

As the DBS bank CEO Piyush Gupta says on his digital strategy, (Tan, 2014)

“That is actually going to make the difference between the banks that will

survive and the banks that will not survive”.

Bibliography:

Frost & Sullivan (2016) Artificial Intelligence

Empowering Digital Banking and Finance Ecosystem-IT, Computing and

Communications. Available at:

http://cds.frost.com.proxy.library.cmu.edu/p/55399/#!/ppt/c?id=D881-00-03-00-00&hq=data%20science%20finance

(Accessed: 13 June 2016). In-line Citation:(2016)

CSC (2014) Big data - CSC global CIO survey: 2014–2015.

Available at:

http://www.csc.com/cio_survey_2014_2015/aut/115261-big_data_csc_global_cio_survey_2014_2015

(Accessed: 13 June 2016).In-line Citation:(CSC, 2014)

World Economic Forum (2015) Future of Financial Services.

Available at:

http://reports.weforum.org/future-of-financial-services-2015/executive-summary/?doing_wp_cron=1465787851.6013619899749755859375

(Accessed: 13 June 2016). In-line

Citation:(2015)

LLC, S.C.S. (2014) Press release. Available at: https://symphony.com/press_releases/item/consortium-leading-financial-firms-invest-new-communication-workflow-platform

(Accessed: 13 June 2016).In-line Citation:(LLC, 2014)

Tan, J. (2014) Piyush Gupta demands A shift to digital

banking in Singapore. Available at:

http://www.forbes.com/sites/forbesasia/2014/06/04/piyush-gupta-wants-a-shift-to-digital-banking-in-singapore/#728fe5f14d09

(Accessed: 13 June 2016).In-line Citation:(Tan, 2014)